History Of Grameen Bank

The grameen bank is a community development bank started in bangladesh they give small loans known as microcredit or grameencredit to poor people without asking for money before the loan is given the word grameen is made of the word gram or village and means of the village.

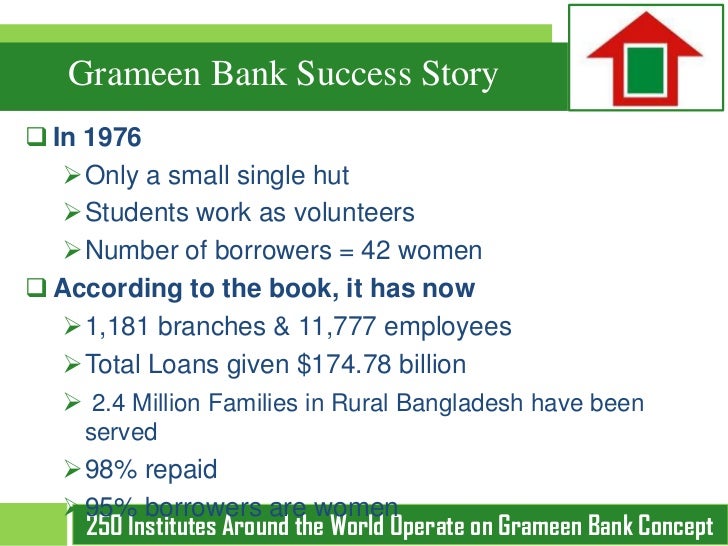

History of grameen bank. Grameen bank on the other hand works on the assumption that even the poorest of the poor can manage their own financial affairs and development given suitable conditions. In bangladesh by 2015 grameen has 2 568 branches with 21 751 staff serving 8 81 million borrowers in 81 392 villages. গ র ম ণ ব য ক grāmīṇ byāṃk. By a bangladeshi government ordinance on october 2 1983 the project was transformed into an independent bank.

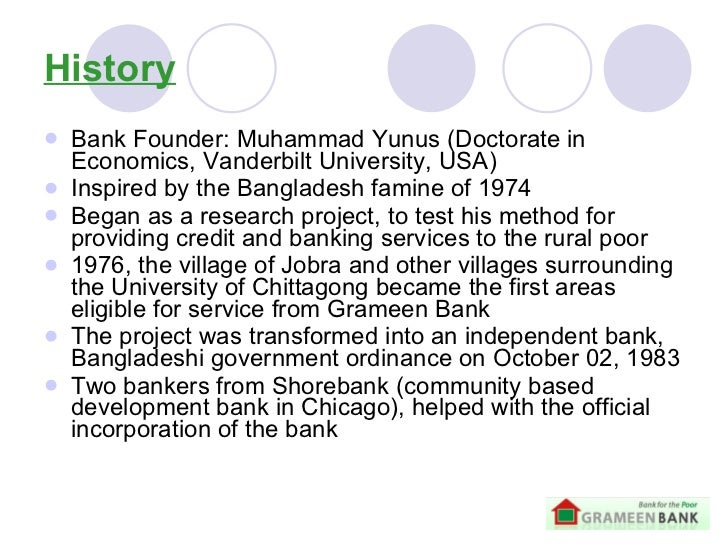

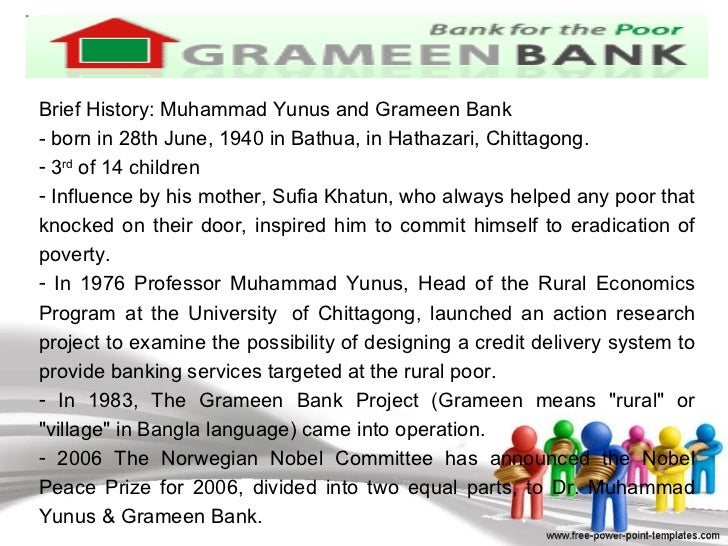

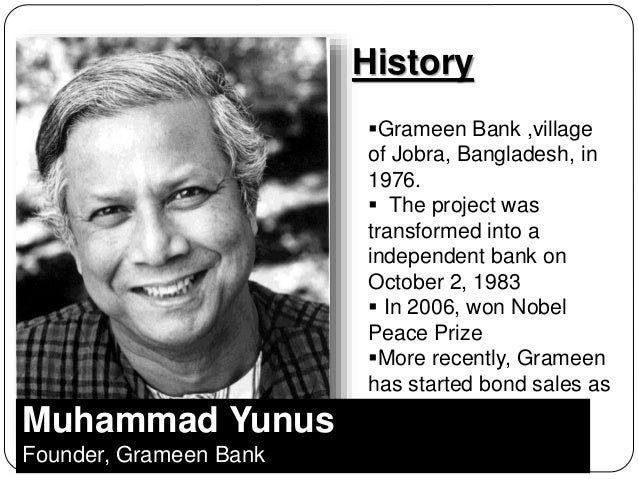

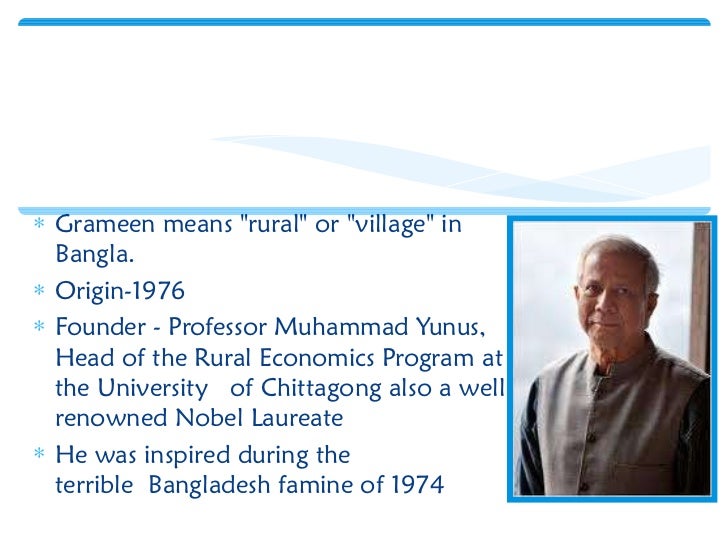

Against the advice of banks and government yunus carried on giving out micro loans and in 1983 formed the grameen bank meaning village bank founded on principles of trust and solidarity. History of grameen bank grameen bank in bangladesh the origin of grameen bank can be traced back to 1976 when professor muhammad yunus head of the rural economics program at the university of chittagong launched an action research project to examine the possibility of designing a credit delivery system to provide banking services targeted at the rural poor. Rural model devised by yunus in 1976 is based on groups of five prospective borrowers who meet regularly with grameen bank field managers. In 1976 the village of jobra and other villages.

On any working day grameen collects an average of 1 5 million in weekly. The average amount borrowed was 100. Grameen bank bangladeshi bank founded by economist muhammad yunus as a means of providing small loans to poor individuals see microcredit in 2006 grameen and yunus were awarded the nobel prize for peace. After this establishment the bank started experiencing tremendous demand from foreigners around the world who wanted to learn further about the operations of grameen bank as well as meet with its staff and clientele.

The instrument is microcredit. Grameen bank originated in 1976 in the work of professor muhammad yunus at university of chittagong who launched a research project to. গ র ম ণ ব ক is a microfinance organisation and community development bank founded in bangladesh it makes small loans known as microcredit or grameencredit to the impoverished without requiring collateral. Die grameen bank bengalisch.

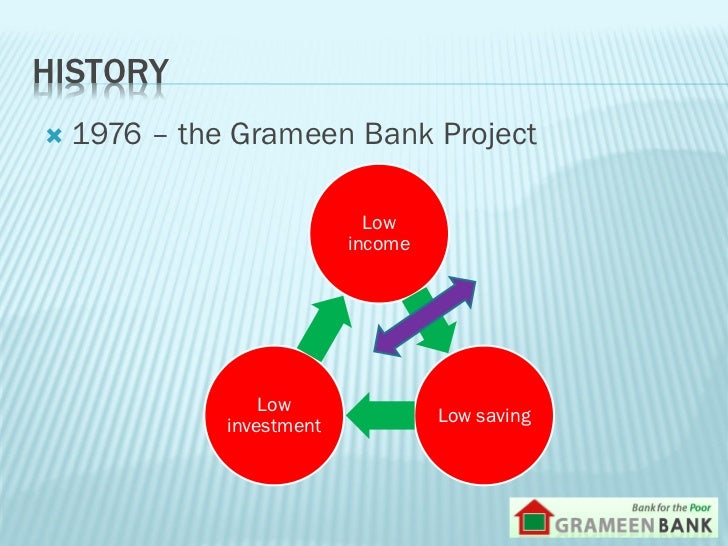

When grameen bank was awarded the peace prize in 2006 more than seven million borrowers had been granted such loans. Yunus developed the principles of the grameen bank literally bank of the villages in bengali from his research and experience he began to expand microcredit as a research project together with the rural economics project at bangladesh s university of chittagong to test his method for providing credit and banking services to the rural poor. Dörfliche bank ist ein 1983 gegründetes mikrofinanz kreditinstitut das nicht mit kreditsicherung sondern mit gruppendruck mikrokredite an menschen ohne einkommenssicherheiten in bangladesch vergibt und damit versucht die armut der bevölkerung zu lindern. The system of this bank is based on the idea that the poor have skills but have no chance to use their.

Due to overwhelming requests from abroad grameen bank.